The traditional annual Microfinance Barometer has been replaced from this year on by the Impact Finance Barometer. The first edition of this new barometer, which includes inclusive finance, green finance and impact investing, was launched at Convergences #3Zero Mondial Forum in Paris on September 2nd, and InFiNe.lu was there.

Focusing on “Financing social and environmental transitions”, the publication presents key figures on impact investing and financial inclusion.

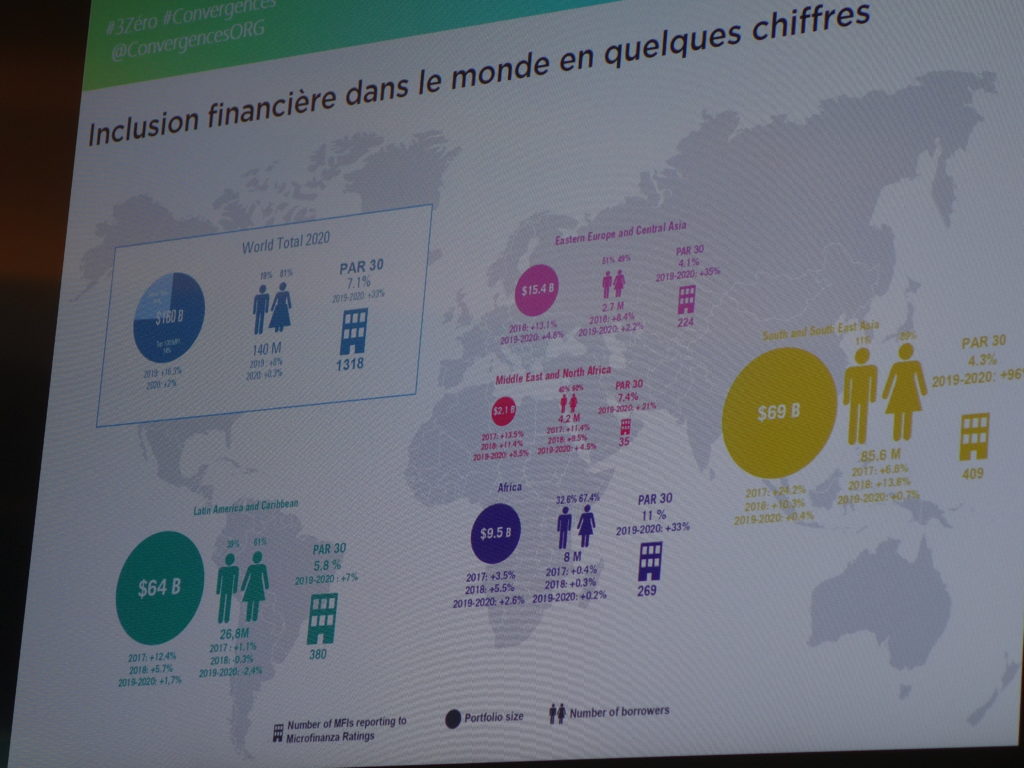

What emerges regarding inclusive finance is that :

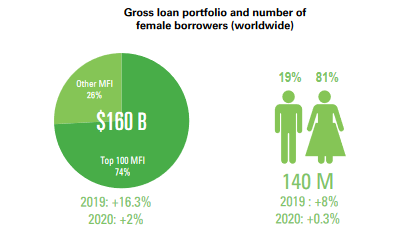

1- the market is dominated by a few (about a hundred) MFIs

2- the inclusion of women is predominant (and recurrent year after year) and is reflected in the percentage of 81% of borrowers

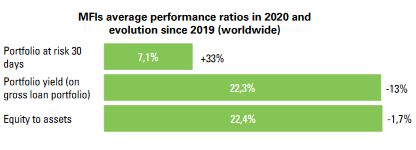

The impact of the COVID crisis on financial inclusion was measured by the investment risk (PAR30). This risk has increased by 33% in 2020. This figure varies by region, but the overall trend is toward an increase everywhere. It is seen to be higher in South Asia and South East Asia, although these reions are known to have a low PAR30.

Despite this real growth in risk, investors have continued to show interest and support for the sector.

(According to data from Atlas, a MicrofinanzaRatings product)

On the impact of the crisis on financial inclusion, Edouard Sers, Risk Director @ Grameen Crédit Agricole Foundation (FGCA), underlines that:

1- the impact of the crisis differs from region to region but is strongly linked to the degree of lockdowns in the region. (The stricter and more repeated the lockdowns, the stronger the impact of the crisis was felt).

2- Despite the risks, the sector has remained resilient.

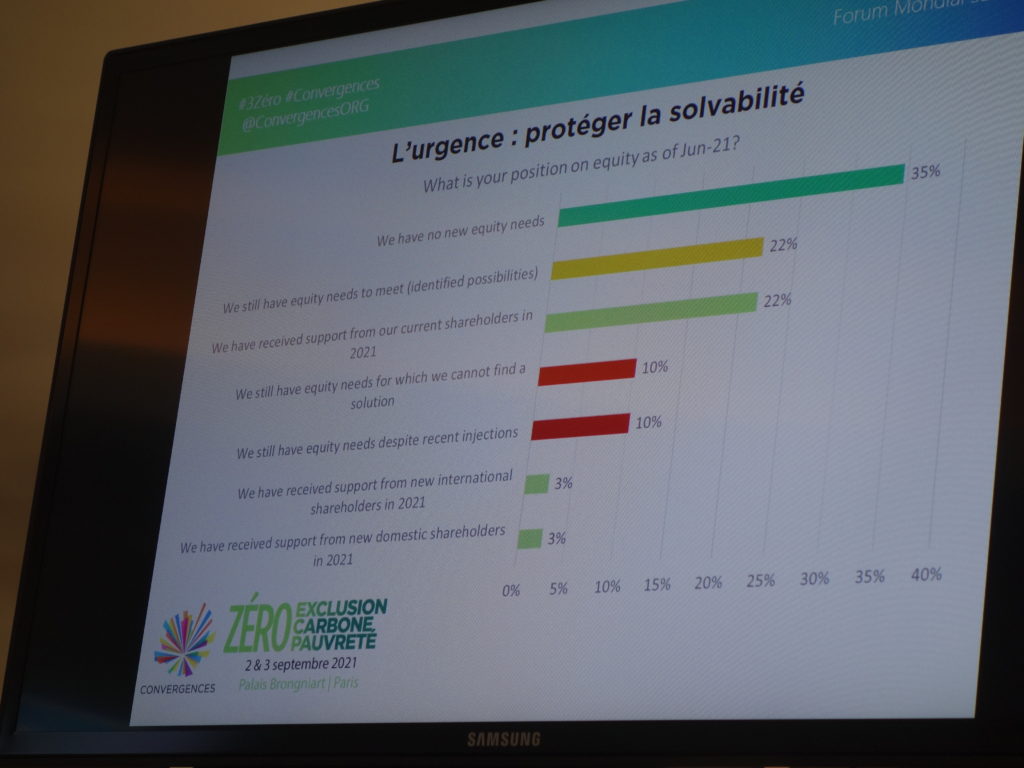

3- One in five MFIs has not yet solved the question on equity

4- MFIs have shown responsible HR management with employment being maintained (even if recruitment has decreased)

5- The liquidity crisis has been partly avoided thanks to the mobilisation and flexibility of investors and the setting up of an MoV and a Pledge “Key principles to protect microfinance institutions and their clients in the Covid-19 crisis” (of which InFiNe.lu is a signatory) to spread the debt

6- The crisis has accelerated the digitalisation of the sector

A lot of data has been collected since the beginning of the crisis with, for example, Inpulse, ADA and FGCA surveying their partners every 2 months.

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

![]()

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth