This conference, organised every two years by European universities, the CERMi and with the support of e-MFP, is a unique moment where the academics, their students and researchers, meet the professionals and practitioners of the sector. For the academic sector, it is the opportunity to confront the results of their research to other researchers and professionals by opening the debates to (constructive) criticism. For InFiNe.lu it was a opportunity to take the pulse of the latest trends analysed.

Nearly 40 research papers were presented, discussed or commented on at the conference, on themes such as “Markets, policies and regulation,” “Gender perspectives in microfinance,” Institutional issues and governance “and “Financial inclusion and COVID-19”. A surprising but familiar exercise for academics in constructive criticism.

Regarding trends, the presentation “Microfinance: state of the art and research agenda” by Professor Robert Lensink (University of Groningen) showed that microfinance seems to attract less and less researchers, who prefer focusing sustainable finance. And when microfinance is the subject of research, it is microcredits that are mostly studied. Very few study savings or insurance.

Most of the research is conducted in sub-Saharan Africa and South Asia, whereas a holistic understanding of microfinance and its tools would require the study of its particularities in other regions. Microfinance being strongly linked to the region, culture and local regulations.

The conference showed that some studies nevertheless focus on what the academic world calls microfinance plus, i.e. non-financial services combined with microfinance. It is these non-financial services that have the greatest impact on the target population. Microfinance does not lift vulnerable people out of poverty, but it does help to smooth their consumption and therefore make them more resilient.

The conference was also the occasion to announce the winner of the Best Graduate Paper Award, awarded by e-MFP. Two awards were presented. The first one went to Naome Otiti for her paper “Gender and staff turnover in microfinance: the moderating role of firm international background”. The second was awarded to Anaëlle Petre for “Are development interventions harmful for self-help groups in Africa? The case of self-sustaining savings groups.”

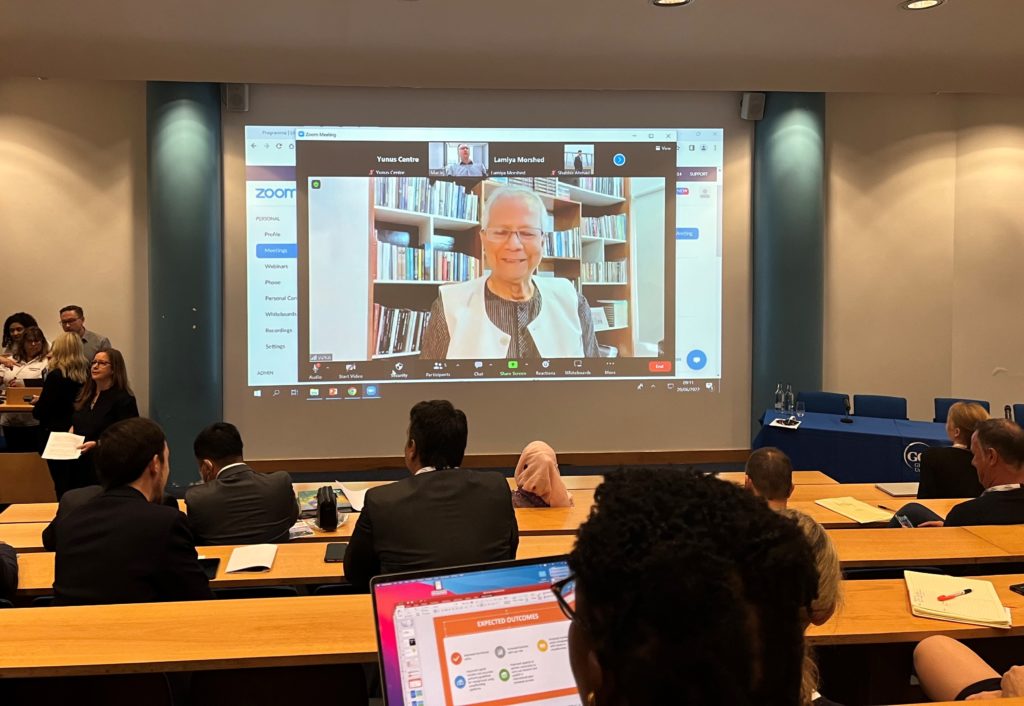

The 7th European Research Conference on Microfinance which gathered more than 100 delegates from 31 countries focused on microfinance research priorities that are aligned with the United Nations Sustainable Development Goals (SDGs). It took place from the 20th to the 22nd June 2022 in Glasgow Caledonian University (GCU), hosted by the Yunus Centre for Social Business and Health. GCU is one of the first universities in the world to adopt the SDGs as a framework for their research strategy.

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

![]()

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth