Fabio Mandorino, Economic Adviser at ABBL (The Luxembourg Bankers’ Association), is currently attending the Oxford Impact Investing Programme thanks to an InFiNe.lu scholarship. Read here the outcomes of what he is currntly learning.

DAY 1 : Landscape of Impact Investing

The Oxford Impact Investing Programme 2019 selected 48 participants from all over the world with different high profiles, background and sectors, including:

The Oxford Impact Investing Programme 2019 selected 48 participants from all over the world with different high profiles, background and sectors, including:

The focus of the first day was on the landscape of impact investing, defined as investment intended to create positive impact beyond financial return. As such, they require the management of social and environmental performance in addition to financial risk and return.

A special accent was put on the momentum we are experiencing, in particular, the alignment of the interests of public and private sectors in supporting investments that could have an impact on environment, social and governance issues.

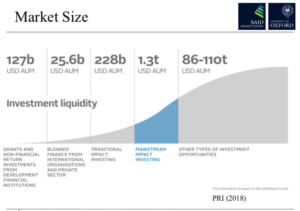

We went through the findings of the annual GIIN report (2018) based on responses received from 229 of the world’s leading impact investing organizations, including fund managers, pension funds, banks. In total, respondents manage over USD 228 BN in impact investing assets (which represents the latest best available “floor” for the size of this market.

Both challenges and opportunities were pointed out during the course. On the challenges side, the most obvious being the lack of scaled investment products. But probably the most important one is that we still haven’t clearly defined what we mean when we talk about impact.

On the opportunities side, the impact investment field offers opportunities in different sectors with various levels of risk and various levels of potential financial returns, different level of risk and various degrees of social and/or environmental impact.

On the opportunities side, the impact investment field offers opportunities in different sectors with various levels of risk and various levels of potential financial returns, different level of risk and various degrees of social and/or environmental impact.

In this context, investors in inclusive finance should be aware of the impact that higher return expectations may have on financial service providers’ prices and hence on end-clients

Finally, the group discussed the Afram Plain case study (the project was to reduce hunger, create jobs and economic opportunities for 80,000 smallhoder farmers) and it was the occasion to use interesting tools like: the human security index and the theory of change (more to come on this).

DAY 2 : Impact measurement and management – Policy landscape and impact investment

The first part of the second day is entirely dedicated to impact measurement and management (IMM), focusing on guidance, tools, and other resources designed to help experts navigate and implement management into their day-to-day operating practices.

IMM tools are essential in making effective impact investments: it means identifying and considering, in an iterative way, the positive and negative effects that each business actions have on people and the planet.

Essentially, 4 actions are required to get started: 1) set goals and expectations, 2) define strategies, 3) select metrics & set targets and 4) measure, track, use data and report. This implies that investing to create an impact means integrating impact considerations throughout the investment management process. In fact, without solid metrics to quantifiably measure results in social and environmental terms, the whole “impact” part of “impact investing” would be worthless.

An example of tool commonly used is the theory of change: it shows the path from needs to activities to outcomes to impact. It describes the changes we would like to make and the steps involved in making that change happen.

The focus of the second part of the day was on policy landscape for impact investment, meaning what Governments can do to grow impact investment. We were confronted with a series of initiatives /decisions that Governments can undertake such as : regulate (tax), legislate (legal forms), invest (creating funds) and also supporting innovation and dissemination.

Among the examples mentioned during the course, I found particularly interesting two: the social impact bond (commissioning tool that can enable organisations to deliver outcomes contracts and make funding for services conditional on achieving results. Social Investors pay for the project at the start, and then receive payments based on the results achieved by the project) and the use of dormant assets deposited in banks that can be channeled to good causes.

So far, the added value of the Oxford impact investing programme it’s not only given by the professionalism of professors, tutors and experts but also by the contributions and experiences shared by all students.

The next three days will be dedicated to impact investing in emerging economies, portfolio development and the role of technology.

If you want to read the outcomes of Day 3 click here

Author: Fabio Mandorino

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

contact@infine.lu

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth