Insight of the Boulder Digital Transformation of MFIs Programme by Violette Cubier (Fondation Grameen Crédit Agricole) – Week 11

This last module was untitled “Strategic Direction for a future beyond classic microfinance”. It was presented by Momina Aijazuddin, who is IFC’s Head of Microfinance/ Financial Inclusion.

A large part of the module was dedicated to strategic leadership. As defined by Momina Aijazuddin, strategic leadership is “the ability to influence others to voluntary make decisions that enhance the prospects for the organisation’s long term success while maintaining long-term financial stability”.

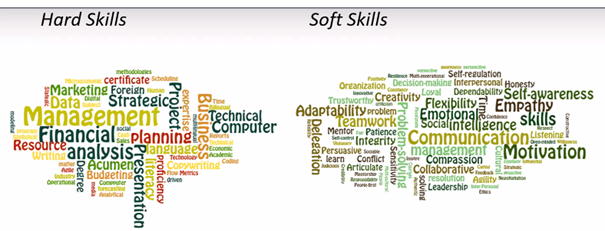

Throughout the module, we got the opportunity to reflect on what are the qualities that a strategic leader must possess, might it be hard skills or soft skills. Many participants reached the same conclusion in saying that soft skills are particularly important for a leader, including communication skills, the capacity to motivate people, self-awareness, self-regulation, empathy, adaptability. All these skills can be defined as emotional intelligence, which is just as important as intelligence measured by IQ.

We then had to work and reflect on the different types of power within an institution (power induced by hierarchy, through the possession of some key resources or of a specific knowledge) and how to best influence / appeal to these different types of positions to make a digital agenda move forward.

Result of the brainstorming of participants on the qualities a strategic leader must possess

The rest of the module was then dedicated to the analysis of the impact of covid on the microfinance sector, with in particular the review of a study by MSC on the impact of the pandemic on low-and moderate-income populations and micro, small, and medium enterprises (MSMEs)[1], but also of the recent trends in digitalization and digital transformation.

As a wrap up of the 10-weeks training, we were encouraged to reflect on our digital strategy in the short, medium and long term. Through the reading of a study from IFC (Turning MFI Digital Strategies into reality[2]), we were reminded of the importance to be extremely clear about our objectives before embarking into a digital transformation process, to have “a compelling business objective that the [institution] can deliver and […] backed up by a realistic and achievable business case”.

As stressed in this paper, it is unfortunately “common for institutions to rush into deploying digital financial services with insufficient strategic planning. Sometimes this is due to internal pressure, sometimes a perceived competitive threat, or even external pressure and encouragement catalyzed by offers of funding”.

Some key strategic lessons mentioned in this paper include:

– it usually takes several years for digital strategies to be successful, and therefore that one needs to be patient and not to expect major impacts in the very short term.

– it is essential to secure the whole organisation’s understanding of, and buy-in to a digital strategy.

– using agents saves approximately 25 percent of the operational costs associated with branch transactions.

– when creating an agent network, it is more important to prioritise quality over quantity – the most successful agent networks are not necessarily the largest. Digital strategies that focus on high quality active agents, rather than high numbers of agents, are always the most successful.

Wrapping up these 10 weeks of training, I must say that Boulder Institute really managed in making the training very interactive, despite the online format. I really appreciated the exchanges between participants and between the participants and the faculty and learned a lot from the experience of other participants. I also believe that Boulder managed to keep the “community” spirit in this training. I did not feel like I was attending any other type of training, but felt a sense of belonging to a group and I am sure the participants will remain in touch after the training.

Some caveats of the training I could mention:

– the 10-weeks format: I found it challenging to consistently dedicate 6 to 8 hours to the training per week, over 10 weeks. I would have found a shorter and more intense format more convenient.

– interactions between the faculty and participants were usually limited to the live sessions. We did have some exchanges in smaller groups with one member of the faculty, and I think it would be very interesting to replicate this in the future.

– the generalist content can sometimes be frustrating. I would have been interested in digging more into some topics (data management, agency banking)… but who knows, Boulder might already be thinking of launching more specific / targeted modules in the future.

Overall, I really enjoyed the training, and would highly recommend it for leaders of institutions that are about to engage in a digital transformation journey.

[1] https://www.microsave.net/wp-content/uploads/2021/01/210127-Impact-of-COVID-19-on-LMIs-and-MSMEs-comparative-study-report-final.pdf

[2]https://www.ifc.org/wps/wcm/connect/industry_ext_content/ifc_external_corporate_site/financial+institutions/resources/field+note+7+turning+mfi+digital+strategies+into+reality

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

contact@infine.lu

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth