Author: Violette Cubier

This week’s module was on strategic and business planning for digitalisation transformation. The module was presented by Glen Tugman (Senior Consultant at Optimum Talent) and Jeremy Pallant (Senior Banking Specialist at IFC), and consisted in videos, live discussions, the study of a business case and exercises to apply the different models presented in the module.

Glen Tugman started the module with a reflection on why formalising a digital transformation strategy is so important:

Financial institutions must transform in response to the rapid changes in customer expectations, increasing penetration of smartphones and new business models and technology that are emerging. Transformational change is however difficult to implement, in particular decisions related to allocating resources. Effective planning is also challenging because customer expectations and technology are changing so rapidly.

Hence, the proposal of Glen Tugman and Jeremy Pallant to simplify business planning by using business planning models. Two models particularly caught my attention:

This model focuses on identifying trends, opportunities, dependencies and constraints for a particular digital project. Trends might for instance include changing customer demands, increased smartphone use, new business models and technologies (apps, cloud, software as a service, artificial intelligence). Opportunities usually consist in new customer segments, new value propositions, new delivery channels or different relationships with customers. Dependencies refer to all key resources and skills, partners, infrastructure that are necessary to run a project and are very often overlooked before launching a digitalisation project. Constraints usually lie in four areas: regulation, financial resources, human resources, and capacity for change.

The Business model canvas is a strategic management tool that helps companies refine their business model and assess the impact of new initiatives using nine building blocks. It facilitates business decision making by highlighting elements that are the most critical for success, and dependencies between different elements.

The tool is useful to reflect on the key elements of a business model before embarking on a digital transformation journey: what are the customer segments, the value proposition, the delivery channels, the relationships with customers, the revenue streams and cost structure, key partners, key activities to undertake and key resources to be able to implement such activities?

Lessons learned on strategic planning

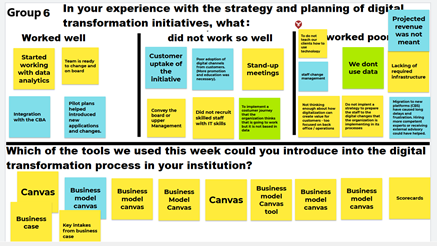

Brainstorming of one of the groups during the live session

Based on the case study (digitalisation transformation of an Asian bank) and on discussions held during the live session, some key lessons can be highlighted for a successful digital strategy development:

To read the learning on week 1 click here

To read the learning on week 2 click here

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

contact@infine.lu

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth