Meet Anne Bastin, Director of InFiNe.

Today, around 2.5 billion people worldwide have no access to financial services.Inclusive Finance aims to provide affordable and reasonable quality financial services, including saving, credit, insurance, remittances, payment methods and non-financial services. This objective is at the core of InFiNe’s mission. InFiNe, Inclusive Finance Luxembourg Asbl, is the Luxembourg platform that brings together public, private and civil society actors involved in Inclusive Finance.

To spotlight the best insights into InFiNe’s network excellence, we ask a few questions to Anne Bastin, Director of InFiNe.

In a recent interview, you stated that “Inclusive Finance is an economic lever”. Eight months after taking over the lead of InFiNe, can you explain what Inclusive Finance means to you? How and in what way do InFiNe members make it an economic lever?

Inclusive Finance is indeed an economic lever because it has the particularity of reaching a very heterogeneous population, contrary to what one might think, and helping those populations to create wealth and be integrated within the traditional financial system. For me, the true definition of Inclusive Finance is finance that answers the needs of all the populations that do not have access to the services of a traditional bank, namely the possibilities to save, credit opportunities, insurance products, and money transfer options,… This concerns young people, isolated women, rural populations, and small merchants in the South, but also in the North. I discovered this more deeply when I took over the management of InFiNe and worked more closely with microlux, one of the 36 members of InFiNe. Microlux provides microcredits and personalised coaching for creating or developing micro or social enterprises in Luxembourg. Beyond this broad definition of Inclusive Finance, which describes the scope of services and the targets, Inclusive Finance is also more than a tool. It is also a philosophy, a way of seeing the world and a support model to reach the Sustainable Development Goals (SDGs). In Luxembourg, I mentioned the work of microLux. But I could also mention the recent Private Asset Impact Fund report by Taméo. In this report, we deep dive into a USD 84 billion market focusing on gender lens investing, fintech and embedded finance strategies. It is pretty interesting to read between the lines the confirmation that impacts investing is much more than just a trend. Investors are increasingly seeking to make a positive environmental and social impact on society and the population in general. Luxembourg’s leadership in promoting the sector of impact investing is critical, catalysing impactful capital towards developing countries. This observation is also shared by another InFiNe member, Innpact, whose co-founder Arnaud Gillin explains in a recent interesting article how the financial sector is undergoing a profound change in the perspective of the ecological transition and why Luxembourg is a leader. If we look at the South, InFiNe members such as Bamboo capital partners, LMDF – Luxembourg Microfinance and Development Fund or Finance in Motion are doing an exceptional job attracting commercial capital towards projects that contribute to sustainable development, while providing financial returns to investors. The multi-stakeholder partnership approach at InFiNe is essential, and Luxembourg has always worked in partnership with different public, private and multilateral actors to create the difference. I am very proud to work at InFiNe with diverse members and a robust network, all working together to advance Inclusive Finance and value Luxembourg as a financially inclusive and microfinance excellence centre.

Approximately 2 billion people are today particularly exposed to global shocks, suffering daily from crises impacting the world: COVID-19, climate disasters, conflicts and wars … leading to economic fallout, which caused extreme volatility and price fluctuations in the energy, food and commodities markets. Besides, food security is the subject of this year’s European Microfinance Award. How is it possible in this very troubled situation to achieve inclusive and sustainable development?

The world we live in is challenging. But there are many reasons to hope. During the past decade, the concept of Inclusive Finance evolved from simple financial products towards financing access to essential services like energy, education or health. As an early adopter and big promotor of Inclusive Finance, Luxembourg continues to support Inclusive Finance as an enabler towards a broader impact-driven economy not focused on growth but on the circular economy, global sustainability and well-being, aiming to reach the 17 SDGs. Through this approach, the private sector is becoming logically more involved along with responsible finance and impact investment actors. And this is our strength at InFiNe. As the Luxembourg platform that brings together public, private and civil society actors involved in Inclusive Finance, we are committed at InFiNe to foster strong collaboration between public and private actors to achieve inclusive and sustainable development. Indeed, the main bottleneck to achieving the SDGs is the need for financing, which is colossal and the old financing mechanisms (donations, philanthropy), which, even if they remain commendable, have shown their limits in the face of the plethora of needs. The private sector, specifically innovative financing mechanisms that call on the private sector, are very effective tools for implementing the SDGs. Among the different instruments “Blended Finance”, which, thanks to public aid from development cooperation or philanthropic donations, can raise funds from the private sector and mobilize greater resources. There are also green bonds, impact funds, and socially responsible investments that contribute to the achievement of the SDGs.

InFiNe has 36 members and a very active network. According to you, what are the three concrete results of this unprecedented multi-stakeholder collaboration and synergy between private and public actors?

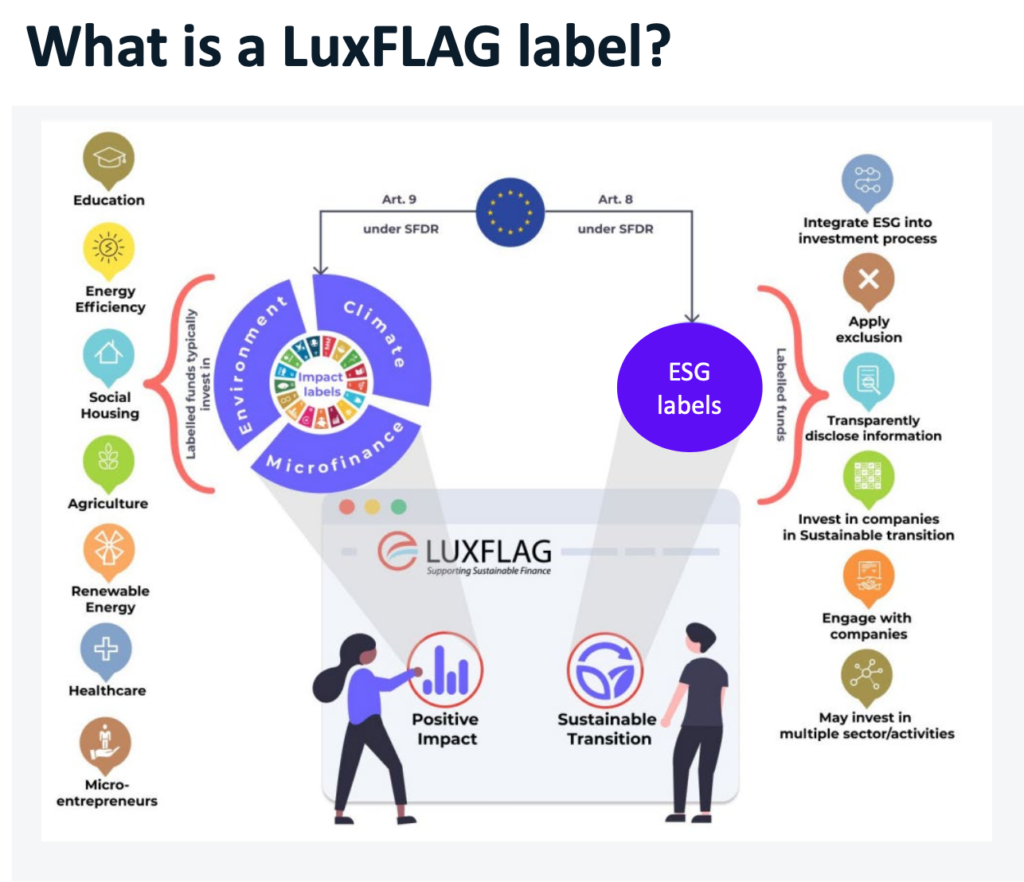

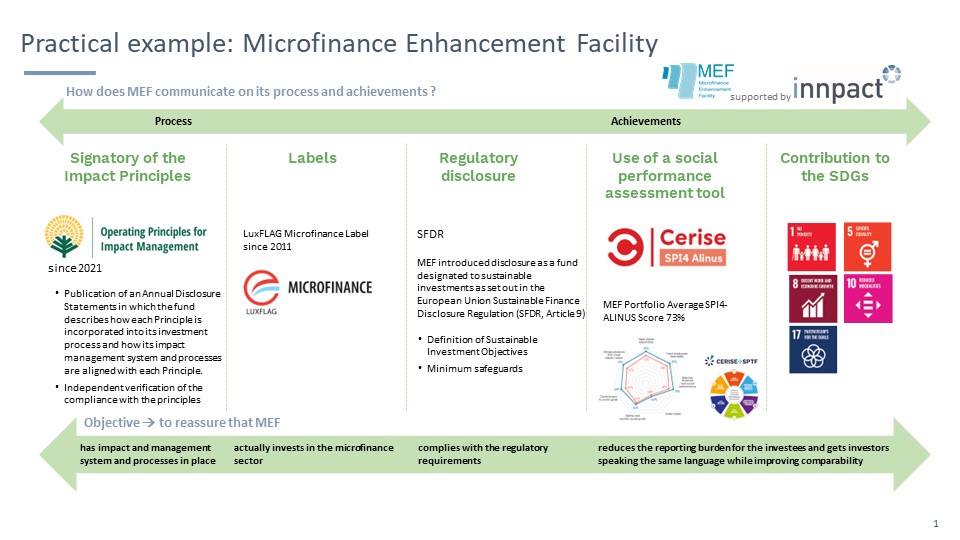

I would not name three concrete results but more a long-lasting impact which is the valuable and insightful networking between the members. During the year 2022, InFiNe continued its knowledge exchange events between members. This is a fundamental activity, and I want to continue and expand it within InFiNe because in order to develop the collaborations that are so essential between the public and private sectors, we must first learn to understand each other and develop partnerships. For example, we organised an event with LuxFLAG and Innpact on November 14th on “The Role of Labels in Impact Finance” to understand the criteria and issues of labelling. LuxFLAG presented the different labels. A LuxFLAG label is a unique tool at the disposal of financial industry actors which they can use to highlight the Sustainability/ ESG/ Impact credentials of their investment and financial products. And Innpact presented the concrete case of the Microfinance Enhancement Facility inclusive journey, which provides short and medium-term financing to financial institutions which support microfinance and microenterprises (MFIs). For the year to come, I want to offer each InFiNe member the possibility to present their work and seek for synergies. I also want to develop the network and bring around the table other types of actors so we transform Inclusive Finance into “the new norm”.

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

contact@infine.lu

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth