Part Three of Learning by Esther Meyer, Fondation de Luxembourg

This month I had a closer look into the sustainable investment strategies and methodologies. I

hope you will enjoy reading this and I wish you some interesting insights.

“There is no right or wrong approach for sustainability, everyone has different requirements

and priorities” is one of the key messages of this unit and, coming from here I will give you

some insights in the different strategies and methodologies.

Sustainability issues and the assessment of non-financial performance is not as standardized

as financial performance or credit risk. It can be managed in different ways and on different

levels. There is obviously a relationship between sustainability and financial risks which is

also recognized by several central banks, for example the Bank of England.

It is of utmost importance to select the appropriate strategy for the management of sustainable

investments and this selection is highly dependent on the priorities of the specific

sustainability issues.

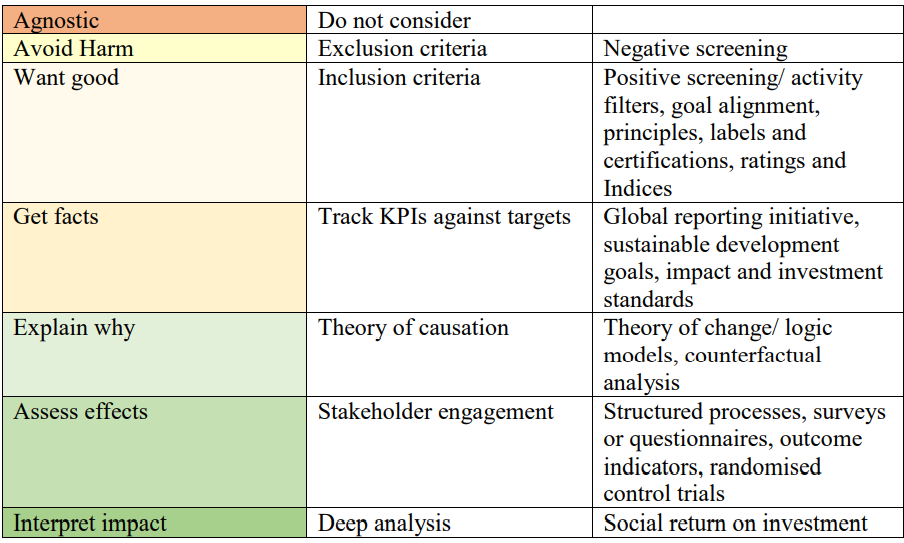

Focus is on the different strategies used in sustainable finance. The approaches are clustered

according to their common attributes and arranged on a spectrum from less to more intense

strategies.

Pathways:

The spectrum goes from “Agnostic” which means no consideration of impact to “Interpret

impact”, which includes a very deep analysis. While there is not much room for interpretation

for the less intense strategies, the more intense strategies are more subjective.One of the chapters is focussing on the integration of sustainability and investment processes.

Ultimately this integration can be summarized into 7 generic steps:

1) Clarify intentions

2) Select approach

3) Set targets

4) Do assessment

5) Analyse data

6) Report findings

7) Take action

Another key message I would like to share with you says that “Compliance with the Impact

Management does not indicate whether there is a positive (or negative) impact”.

When executing the selected sustainability strategy, the following issues and information

sources need to be considered:

Finally, the monetisation of outcomes was explained and discussed.

In the context of unit 4 I recommend to watch the following videos, both already several

years old, but still very inspiring and worth to watch:

1) A keynote speech of Paul Polman (at that time CEO of Unilever) at an UN PRI

conference 2018

https://www.youtube.com/watch?v=YtXMOUvRf4M&t=5s

2) Pavan Sukhdev, TEDGlobal 2011 “Put a value on nature”

https://www.ted.com/talks/pavan_sukhdev_put_a_value_on_nature?language=en

During the next weeks I will be busy with unit 5 which is about ESG data and my

assignment. I will betray you some details and results about it with my next report in about

one month. Until then please take good care and stay healthy.

If you want to know about Part 1 click here and for Part 2 click here.

Author: Esther Meyer

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

contact@infine.lu

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth