While the positive effect of accelerated digitalization that happened during the Covid-19 pandemic can be felt in our everyday life, it is less obvious to imagine the kind of benefits it brought to emerging markets. Indeed, we might think that developing countries were not prepared for the technological shock. Counter-intuitively, it is where digital adoption happened the fastest and will have long-lasting effects. A study by McKinsey[1] showed that the customer rates of adoption of digital services were faster in 2020 than in previous years

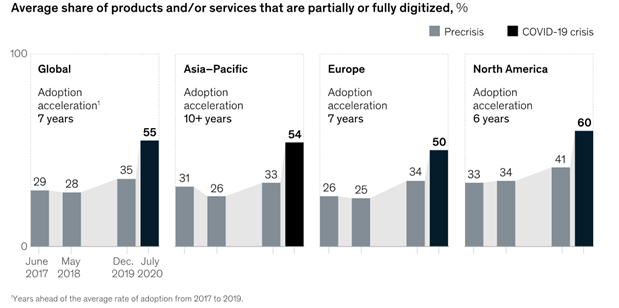

The graph below looks at the share of products and services that are partially or fully digitized. It illustrates well the acceleration of customer rates of adoption for the Asia-Pacific region, where the adoption acceleration of digitalized products is equivalent to more than 10 years, compared to 7 years globally. One of the reasons for the faster deployment of digital solutions in Asia-Pacific, compared to other nations, was their lower rate of use before Covid-19. In fact, the rapid spread of technology in developing countries was possible thanks to the democratization of mobile phones in the last decade.[2] A recent study by the EIB has shown that in 2019, 45% of Sub-Saharan African population subscribed to mobile services. While in North Africa, mobile penetration reached 77%, with 75% of the population using mobile phones.[3]

For the digital revolution to keep going, policymakers in developing countries will need to conciliate the benefits of investing in digital connectivity and the need to invest in basic infrastructure such as water, health care or education. “They will likely have to use public-private partnerships and other vehicles to crowd in private capital to invest in IT infrastructure.”[4]

One of the sectors of interest for microfinance development in the era of digitalization is the banking sector. The first example of digital banking success lies in bKash Ltd[5] in Bangladesh. Designed for unbanked people, the bank offered mobile payment services since 2014 and during the pandemic, unlocked the option for customers to enrol directly via the mobile phone app. Since the pandemic, accounts have only continued to grow, reaching 54 million accounts as of July 2021.[6] The government used the mobile banking services of bKash to distribute social safety-net allowances.

In the Philippines, BPI Direct BanKo, a Microfinance Institution (MFI) that makes microloans to entrepreneurs, decided to modernize its credit scoring model and develop new products where the lending process is almost completely digitized.5 Supporting microentrepreneurs became very important at a time when e-commerce was boosted by people turning to online shopping. The sales of Mercado Libre, Latin America’s online marketplace, doubled between the second quarter of 2019 and the same quarter in 2020.[7]

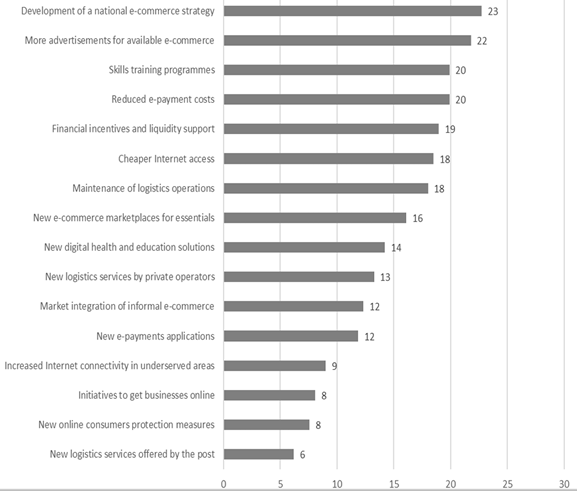

E-commerce and digital economy related measures in selected developing countries (percentage)

The shift to the digital economy mainly happened in the e-commerce sector as illustrated by the above chart. During the Covid-19 pandemic, reduced e-commerce costs and new e-payment applications adopted by 20% and 12% of respondents respectively catalysed the growth in the use of digital payments. The Global Findex Database 2021 has shown that in 2021, in developing economies, “18% of adults paid utility bills directly from an account.” More interestingly, one third of these adults did so for the first time after the beginning of the COVID-19 pandemic.[8]

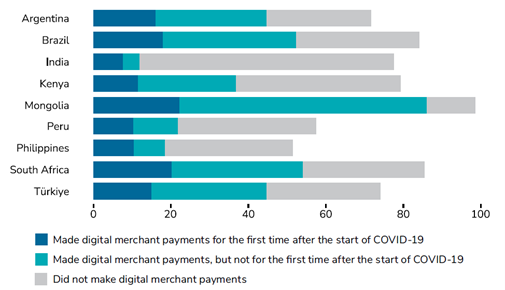

The use and adoption of digital merchant payments during COVID-19 varied across developing economies, adults with an account (%), 2021

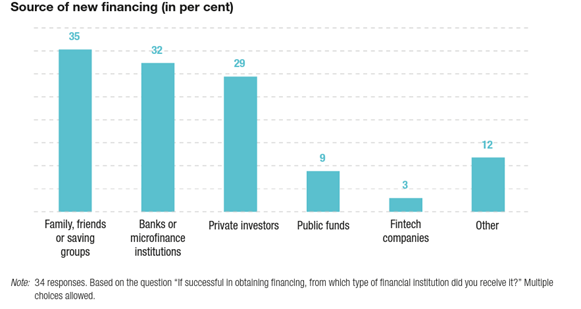

The access to financing remains an obstacle for the development of digital products and services in developing economies and especially in LDCs.[9] A survey that investigated the different aspects of COVID-19’s impact on e-commerce businesses[10] showed that only 14% of all respondents managed to obtain funding. Among those who successfully obtained funding, one third relied on informal sources and only one third could benefit from banks and MFIs support.

Therefore, microfinance will play an important role in sustaining the digital transformation in developing countries in a post-Covid economy. To spur microfinance growth, collaboration among public and private sectors will be needed to limit the adverse impacts of Covid-19. The digital wave will continue to reach all developing countries bringing new opportunities to Microfinance Investment Vehicles to finance sectors such as fintech, e-commerce and clean tech. In turn, the increased internet availability and the use of more sophisticated technologies will create better jobs for local populations.

In a nutshell, the digital revolution was rapidly expanding prior to the Covid-19 pandemic, but the latter acted as a catalyser of digitalization. The digitalization that took place was an enabler of financial inclusion and resilience. Nevertheless, the role of digitalization in the recovery from the pandemic will depend on the capacity of governments to sustain digital public infrastructure expansion, including international cooperation, and private investments. Lastly, digital payments are paving the way for wider use of financial services in emerging markets.[11]

[1]How COVID-19 has pushed companies over the technology tipping point—and transformed business forever; McKinsey; October 2020, https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/how-covid-19-has-pushed-companies-over-the-technology-tipping-point-and-transformed-business-forever

[2] “83% of adults in developing countries have a mobile phone as of 2018” https://www.brookings.edu/blog/future-development/2019/04/10/mobile-phones-are-key-to-economic-development-are-women-missing-out/#:~:text=Fresh%20Gallup%20World%20Poll%20data,they%20need%20to%20escape%20poverty.

[3] The rise of Africa’s digital economy, EIB, 2021, https://www.eib.org/en/publications/the-rise-of-africa-s-digital-economy

[4] Said Bogolo Kenewendo, Managing Director of Kenewendo Advisory and former minister of investment, trade, and industry in Botswana. https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/digital-adoption-in-developing-countries

[6] Out of crisis, Digital Opportunity; IFC; September 2021 https://www.ifc.org/wps/wcm/connect/news_ext_content/ifc_external_corporate_site/news+and+events/news/insights/digital-adoption-in-developing-countries

[7] Source: UNCTAD, 2020b, COVID-19 and e-commerce: impact on businesses and policy responses, available at https://unctad.org/system/files/official-document/dtlstictinf2020d2_en.pdf

[8] Global Findex database 2021 Report; https://www.worldbank.org/en/publication/globalfindex

[9] least developed countries (LDCs)

[10] COVID-19 and E-commerce Impact on businesses and policy responses, United Nations Conference on Trade and Development (UNCTAD), 2020 https://unctad.org/webflyer/covid-19-and-e-commerce-impact-businesses-and-policy-responses

[11] https://www.cgap.org/blog/global-findex-digitalization-in-covid-19-boosted-financial-inclusion

Author: Anna Letta, Sustainable Operations Officer at LuxFLAG. Anna recieved an InFiNe.lu scholarship to attend the Certified Expert in Microfinance organised by the Frankfurt School. This article gives her insight of the training.

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

contact@infine.lu

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth