(An article written by InFiNe.lu scholar Alejandro Vazquez, on his experience attending the Back to Boulder programme 2022).

This note focuses on my personal insights and learning outcomes, particularly as fund manager of LMDF, a Microfinance Investment Fund, from the module 2 “Adapting to a Change Environment“ of the Back to Boulder (B2B) training held in English and French between March 17th to 31st 2022.

This note starts by emphasizing that change is inherent in life and most specifically change as a constant in the Microfinance business. It stresses how recent COVID19 pandemic has accelerated the digital transformation.

Secondly, this notes gives an overview of the main change opportunities that Microfinance Investment Funds have to consider, more particular those that LMDF is constantly evaluating.

The note then lists some of the main challenges that change conveys, in the context of a Microfinance Investment Fund, and how leadership can prepare and assess its team before starting a new project or implementing a new change in their organization.

Finally his note ends with a short conclusion and personal and reference for further reading.

Life is by definition change, nothing stays as it is. As the popular proverb says “there is nothing permanent except change“. Disruption change, meaning significant unexpected change, is the normal for many Micro Finance Institutions (MFIs) and Microfinance entrepreneurs. Some examples of disruptive events that are common and seen repeatedly are agriculture floods, earthquakes, economic or political crisis, death.

The COVID19 pandemic has not been the exception, causing disruptive change on the way people interact, the way finance institutions reach their clients and the different digital services they can offer. This new normal of the world has accelerated the need for organizations to transform and push boundaries to new frontiers with advance technology (applied technology).

This continuous changing environment is also a reality to Microfinance Investment funds, like LMDF (Luxembourg Microfinance Development Fund). In LMDF, we have to constantly evaluate the way we approach our clients, the way we perform due diligence for new investment proposals, the way we evaluate country risk and exposure limits, the way we monitor and collect impact data to drive decisions, etc.

By recognizing that there is a changing environment, we are also recognizing that there are/there will be opportunities that a changing environment will bring; either an opportunity to enter a new business model, the opportunity to fulfil a need not previously existing, or not previously possible to full fill, or the opportunity to save costs, etc.

In the context of a Microfinance Fund, in the assessment of our changing environment we need to always consider the needs not only of our customers (MFIs) and our investors (private and public investors) but also those needs of the clients of our partner MFIs, the End Customers. We need to identify how we can contribute to alleviate poverty and ensure financial inclusion in this changing environment. As leaders in the area, we have to constantly ask ourselves the questions: is there a new technology now that can help use reach those we couldn’t reach before? Can today we do things differently? Has something change that we can now report and measure new impact metrics that help us decide where to invest and deliver a real impact?. Bottom line, the priority and reason of existence of the majority of the Microfinance Investment Funds, including LMDF, is how to channel investors assets to solve the pressing needs of those who need the most, the End Customers. The latter, our end customers, are those who are demanding a change, an improvement to their life.

Accelerated by the COVID19 pandemic, it is now clear that technology has done a big step towards financial inclusion and the End Customers are now expecting a better digital experience across various products and services. Although the Back to Boulder training course focused on MFI’s and their digital transformation, certainly I believe there are also different ways a Microfinance Investment Fund can directly and indirectly contribute to it.

Microfinance Investment Funds can support directly the experience of the End Customers by revising and upgrading together with their MFIs the different systems and processes we currently use for 1) performing due diligence, 2) monitoring financial performance or 3) collecting impact data,. We can also improve our internal approval processes and KYC verification system, so we can become more agile and flexible in lending to the MFIs.

Leveraging LMDF Microsoft cloud services with other service providers and advisors has the opportunity to maximize agility and drive more cost-efficient operations. The opportunity relies that with lower internal costs for lending, Funds can lower their loan pricing and MFIs can translate this lower financing costs indirectly to End customers.

As there are opportunities, there are also challenges. Like with any other business, the largest challenge that Microfinance Investment Funds leaders will have when navigating in a constant change environment, is the human element.

By human nature, we are always scared to change; we have a natural fear of loss. The Elisabeth Kuebler-Ross stages model of Grief, introduced by the Boulder faculty, explains the psychological journey to coupe with death and fear of death, that can also be adapted to explain change. Leadership needs to understand this process and embrace change with courage to help employees to overcome their fear to change and arrive to the acceptance level. With personal example, a proper communication along the process, by empowering employees and stakeholders, and reassuring employment continuity to employers, leadership can play a critical role to overcome this challenge.

In addition, to drive a successful digital transformation, the organization (the Microfinance Investment Fund) has also to a) invest time and resources into new technology in order to automate its processes, b) has to establish governance structures to make faster decisions with broader set of information, and c) has to ensure the access and accuracy to the set of information.

The following section, addresses in more detail the main challenges we face in particular at LMDF to drive the changes we need:

The constant pressure to change into a more digitalized service world, has fuelled a greater urgency to enhance skills of our LMDF Finance talent and build our professional capabilities. Our target, is to become a team that can manage the proliferation of automation — as well as the ever-growing business demands of frequent, granular, high quality information across the enterprise and broader market ecosystems.

In our particular case, LMDF is currently struggling to find the right balance of skills; on one hand hiring new students and graduates from Lux University with a strong technical background and IT knowledge but still a lack of experience in the microfinance world; on the other hand experience professionals and employees will need to develop further new IT skills sets and most importantly embrace the change.

LMDF is now focused on building this mix of talent so we can achieve the agility and business acumen required to perform standardized day to day operations together with the strategic and advisory innovative mindset to drive an leverage technologies and data analytics.

As a SICAV fund, the finance operations of LMDF require to maintain the task based- standardized operations:

In addition, the strategic function will need to drive decision making for operational change, plan future growth and build new business models evaluating risks and scenarios.

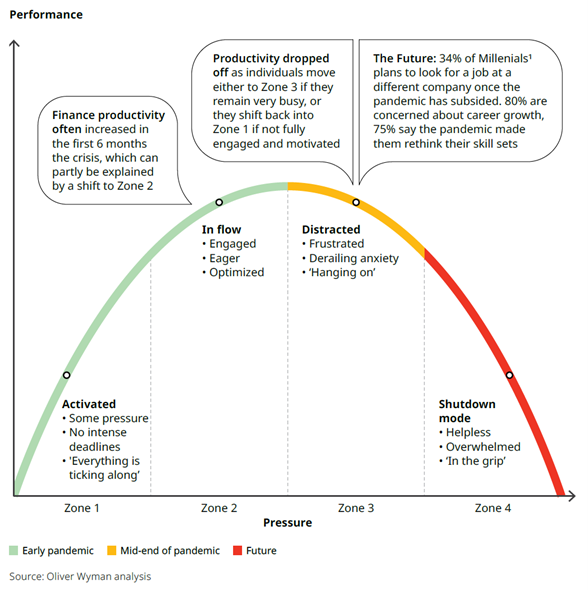

The pandemic has profoundly impacted employee experiences and changed employee work-life visions. As observed from the graph below, sourced from Oliver Wyman analysis and presented by the Boulder training, the study concludes that finance productivity increased in the first 6 months of the lock down , work from home period. However, productivity dropped as individuals become frustrated, or overwhelmed.

Today, maintaining employees’ wellbeing and flexible working options is paramount for LMDF to retain talent and achieve sustainable performance. At the beginning of the pandemic, LMDF established a working from home policy (also mandatory certain periods due to Luxembourg measures to control the pandemic). Although at the beginning we welcomed positively the working from home policy with an increase in productivity and engagement, later productivity dropped off as our team experienced either frustration with their situation or isolation, as we lacked the office natural interactions. Therefore, flexible workplace dynamics, such as work-from-home arrangements with monthly quotas have shifted “from imposed to optional,” and we have now developed a better balance. T

On the other hand, working from office arrangements has helped us to developed not only new skills that we had not considered important previously, but also put into question our current skills and embrace change with a positive mindset. The “office time” has allowed us to re-establish colleague personal relationships and to have, as a team, a clearer vision and direction of the duns strategy. It has also helped us to share and celebrate the success of the fund: a large increase of the portfolio up to EUR 38m following a COVID period of almost no new disbursements, confirmed recovery of our MFIs with strong social and inclusion impact results, etc.

In LMDF, since the start of the Pandemic, we established remote infrastructures to leveraged the previously existing Microsoft Cloud tools. This was a good step towards a more robust and accessible infrastructure, however, we now aim to improve the accessibility and accuracy of our information available to our board of directors. Moving from report generation to self-service analytics will require to re-think the Data Infrastructure and automate the different dataflows in order to limit human intervention and reduce costs and errors. The process will require also to migrate current data to this new infrastructure. It will be advisable, in our case for example, to ensure that LMDF portfolio data and MFI data are accurate and that data covers the require historical granularity needed for future reporting.

Any new data infrastructure will have dedicated data warehouses, with in-built internal data analytics and customized data visualizations and KPI dashboards (in LMDF we have opted for Power BI as a standard Microsoft solution). A very important step to achieve this is the definition and selection of appropriate KPIs that serve as a support to take decisions.

When building the infrastructure, it is also important to consider the forever evolution and change of our business, for example Microfinance Funds needs to report this coming year under SDFR article 9 standards. Therefore Infrastructure will need regular investment to ensure it evolves and remains flexible. This means that not only investment commitment in technology is required, but also revision of KPIs, and data analytics have to be adapted accordingly.

As part of a team preparing or leading a project for change, first we have to adopt a growth mindset and the ability to work and embrace new projects. Here at LMDF, we have started a continuous review and rethink of the next generation of systems and process for our Fund that will streamline the operations and workflows, reduce direct costs as well as provide opportunity for deeper collaboration among or advisors, consultants, service providers and stakeholders.

For the new project this summer, we have decided to launch the LMDF KYC data workflow project, a project to improve the current process for approving a new disbursement KYC. As first step, we have evaluated the current system and identified its limitations. Based on this analysis, our next step will be to analyse the resources and IT infrastructure already in place to select the new technological platform that we will use. In parallel, we will have to determine the resources, time and money, needed. To perform this effectively we are involving, form the beginning, the main stakeholders in the process, ADA our investment advisor. Eventually we will have to run with them different scenarios to evaluate the benefits and limitations we will obtain with this project in order to manage all stakeholders expectations in terms of time and capabilities: easier transfer of KYC data, follow-up of approval status, automated data flow, protection of data confidentiality, etc.

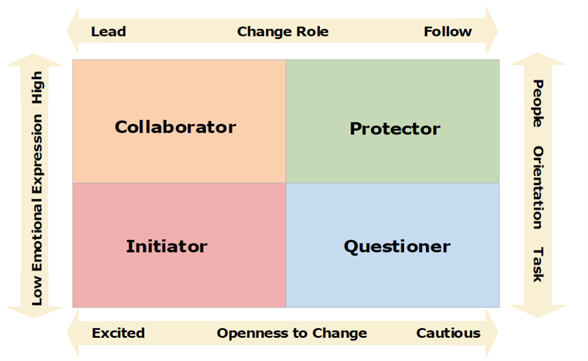

Identifying the team of people who will adopt the new process and their approach to change will be an important factor to successfully of the new process. One interesting framework discussed and introduced by the Boulder faculty is the Ryan Change Style self-assessment. In this framework, each member can self-assess how an individual will prepare and respond to change. Having a style identified helps the team to rely on each other and understand different perspectives. Most importantly it also helps identify the different inputs needed to conceive and manage the project. It also helps leadership team to tailor the communication and updates on the project evolution. The Ryan Change style framework identifies four different dimensions (for more reference, please refer to works cited section of this article):

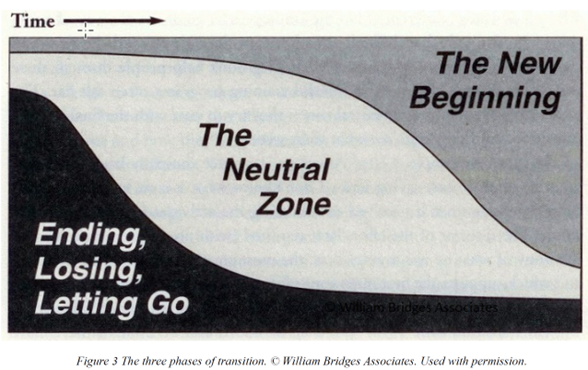

The second tool presented during the Boulder training was the Bridges transition model. The model defines three phases of transition:

Identifying which team member is going through the different transition stages will also guide leadership to help them cope with the loss of the old and the embracement of the new beginning

In summary, Microfinance Investment Funds, as many other businesses and institutions, have to deal and survive within an environment of continuous change. It is important for leaders of these institutions, to fully embrace this change environment and focus on how to capitalize on the opportunities that they entail, while aware of the challenges embedded with them.

The largest challenge to change is the human element. By nature, we have a natural fear for loss, so change is not easy. However, managing and preparing the human dimension of change represent a huge opportunity to capitalize on those opportunities and consequently have a significant impact on financial inclusion for the End customers, those who are the main reason for Microfinance Investment Funds to exist.

InFiNe is the Luxembourg platform that brings together public, private and civil society actors involved in inclusive finance. The value of InFiNe lies in the wide range of expertise characterised by the diversity of its members.

With the support of

Inclusive Finance Network Luxembourg

39, rue Glesener

L-1631 Luxembourg

G.-D. de Luxembourg

Tel: +352 28 37 15 09

![]()

R.C.S. : F 9956

Legal notice

Privacy notice

Picture 1 © Pallab Seth